Get Started With

servzone

Overview

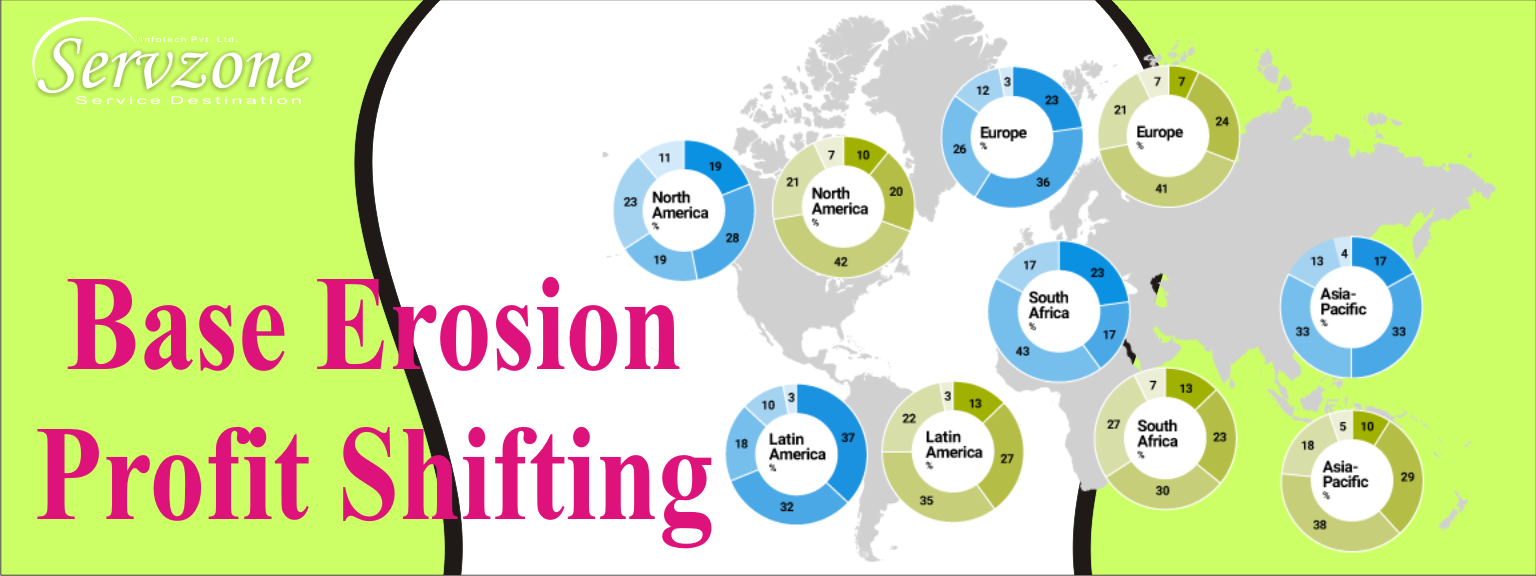

The international tax system is changing rapidly due to coordinated actions by government and unilateral arrangements as designed by individual countries both are intended to tackle concerns over BEPS and perceive international tax avoidance technique of high-profile multinational organizations.

Assistance

- We will assist to determine the overall strategy of the MNE group on the basis of BEPS provisions and also assist in complying with the new requirements arising product wise.

- We can also provide assistance in analyzing various intangibles and also to determine whether the group members contributing towards development, maintenance, protection and exploitation of intangibles which are being rewarded appropriately in line with the Significant People’s Functions

- To review and evaluate the company’s readiness and preparation in respect of TP Compliances and obligations and equip the group to meet the documentation requirements to maintain the alignment between local and global documentation

Actionable

- On the demand of G20 finance ministers, the OCED (Organization for economic co-operation and development) has launched an action plan on BEPS in July 2013.

- This action plan shall with the help of various reports, set of standards and recommendations help to prevent BEPS and prepare government how to tackle with domestic and international instruments which prevent corporations from paying little or no taxes.

Important Points

Based on the recommendation of BEPS and worldwide in-depth scrutiny by the tax authorities mainly involves intangible transactions. Tax authorities are likely to draw inference and support from OCED and BEPS guidelines to determine return from intangibles. These guides in how to analyze various Intellectual Property Rights, brands etc. and how they are positioned and whether all the group members contributing towards development, enhancement, maintenance, protection and exploitation of intangibles which helps to determine:

- Location of the IPR and place of conceptualization and development of IPR

- Legal ownership or the beneficial ownership of intangibles and related payment

- Three Tier TP documentation containing country by country reporting: As recommended by the OCED, three-tier documentation involves transparency in reporting which involves:

- Applicability to all MNE’s whose ultimate parent is resident of countries to which OCED/G8/G20 regulations are applicable

- Requires providing an overview of the MNE’s global chain

- Identify whether the revenue and profit generated from all jurisdictions are proportionate with the substance

- Detect artificially shifting of the substantial amount of income to advantageous environment having taxation benefits by means of automatic exchange of information between the tax authorities

- Recognizing location of the groups where they enjoy tax incentives

Required Documentations

- Master File to provide the MNE’s Blueprint

- Local file to provide material TP positions of the local entity with its foreign affiliates.

- CBC reporting to provide jurisdiction wise information

Key features

- Conduct training which will involve knowledge sharing sessions to increase the awareness of three-tier documentation requirements its structure and compliance requirements

- Perform diagnostic review to assist in preparing TP compliance obligation

- To analyze the intangibles on the basis of BEPS guidance to ensure that the group members are contributing towards enhancement,development, maintenance, protection, and exploitation of intangibles and being remunerated appropriately

- To develop process and procedures for compliance and train the group members to meet documentation deadlines to ensure the alignment between local and global documentation

GST Registration

PVT. LTD. Company

Loan

Insurance